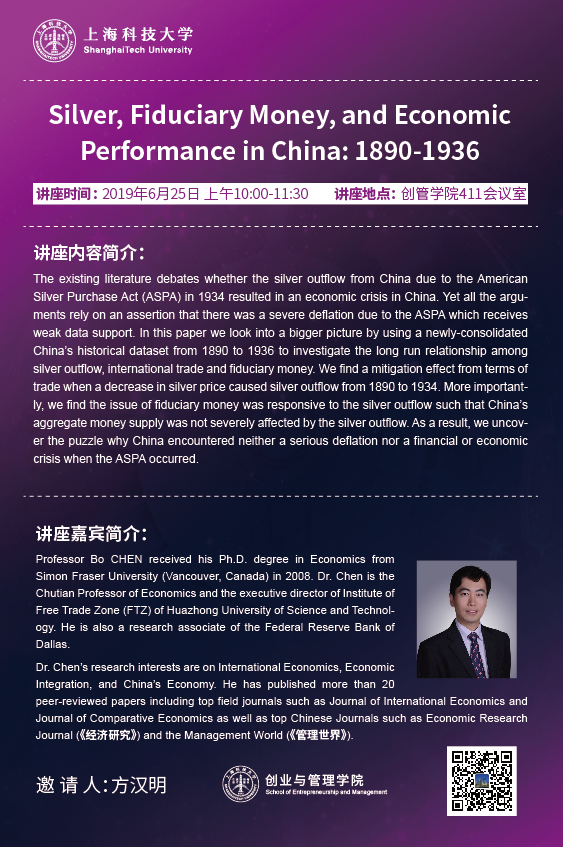

讲座时间:2019年6月25日 上午10:00 - 11:30

讲座地点:创管学院411室

讲座嘉宾:陈波(华中科技大学教授)

邀请人:方汉明

讲座内容简介:

The existing literature debates whether the silver outflow from China due to the American Silver Purchase Act (ASPA) in 1934 resulted in an economic crisis in China. Yet all the arguments rely on an assertion that there was a severe deflation due to the ASPA which receives weak data support. In this paper we look into a bigger picture by using a newly-consolidated China’s historical dataset from 1890 to 1936 to investigate the long run relationship among silver outflow, international trade and fiduciary money. We find a mitigation effect from terms of trade when a decrease in silver price caused silver outflow from 1890 to 1934. More importantly, we find the issue of fiduciary money was responsive to the silver outflow such that China’s aggregate money supply was not severely affected by the silver outflow. As a result, we uncover the puzzle why China encountered neither a serious deflation nor a financial or economic crisis when the ASPA occurred.

讲座嘉宾简介:

Professor Bo CHEN received his Ph.D. degree in Economics from Simon Fraser University (Vancouver, Canada) in 2008. Dr. Chen is the Chutian Professor of Economics and the executive director of Institute of Free Trade Zone (FTZ) of Huazhong University of Science and Technology. He is also a research associate of the Federal Reserve Bank of Dallas.

Dr. Chen’s research interests are on International Economics, Economic Integration, and China’s Economy. He has published more than 20 peer-reviewed

papers including top field journals such as Journal of International Economics and Journal of Comparative Economics as well as top Chinese Journals such as Economic

Research Journal (《经济研究》) and the Management World (《管理世界》).

Dr. Chen has been invited to give talks at the Ministry of Treasury and the Ministry of Commerce of China on issues such as Belt & Road, FTZ, SOE Reforms. He has also given keynote speeches on China Macroeconomic Policies and Reforms to many leading business groups and think tanks such as the Goldman Sachs Group, HSBC, the Deutsche Bank, BAML, Citi Bank, BMW, the Asian Society, the Rhodium Group, and CEPII.