Professor Xiaoyu Zhou, collaborating with Professor Yanlong Zhang from Peking University and Professor Heli Wang from Singapore Management University, studied empirically how Chinese firms translate their Corporate Social Responsibility (CSR) activities into financial market value through multiple paths. This research has been recently published on the Academy of Management Journal, titled “Dare to Be Different? Conformity vs. Differentiation in Corporate Social Activities of Chinese Firms and Market Responses.”

The Academy of Management Journal (AMJ) is the flagship journal of the Academy of Management, known for its rigorous academic standard and high-level quality. It is listed as one of the top 24 journals in economics and management by UT Dallas, as well as one of the top 50 journals recognized by Financial Times in ranking business schools by research. Key research areas in AMJ include strategic management, organizational theory, human resource management, and organizational behavior. Prof. Xiaoyu Zhou is among the few scholars in Mainland China who have published in AMJ.

With the integration of business and society, an increasing number of enterprise managers have placed special value to social responsibility, and CSR has been regarded as a core concept in modern management practice. When practicing CSR, firms conduct business activities beyond the standard by ethic, law and/or public norms, taking into consideration the impact of business activities on relevant stakeholders.Fundamental to CSR is to run business in a sustainable way, which asks firms to make an effort to balance business operations and natural and societal environments. However, CSR activities often consume considerable resources and capabilities of firms. Whether these activities can contribute to the market value of a firm, is therefore not only a key concern for corporate decision making but also an important input for financial-market investors to evaluate the firm.

While CSR is still a relatively new concept for both firms and market stakeholders in China, a great number of Chinese firms are practicing social responsivity and make their practices public by publishing CSR reports. These reports then become the informational base on which financial markets interpret the firms’ CSR practices. Yet the quality of the reports is relatively poor - almost half of them show inadequate details or scope and disclose only a small number of indicators for analysis - making it difficult for firms to effectively realize their market value through CSR disclosure. One reason for this problem is that firms know little about how the stakeholders process their CSR activities. It is thus an important research question how stakeholders in financial markets evaluate firms’ CSR activities.

Figure 1. Corporate Social Responsibility in light of sustainability

Source: https://blog.involvesoft.com/good-corporate-citizenship

To address this gap, Prof. Zhou and collaborators creatively analyzed how security analysts evaluate firms based on their CSR activities. Security analysts acts as information intermediary in security markets, whose reports on the listed companies and recommendation of their stocks would affect stock price and the market value of the companies. Security analysts’ judgment are therefore highly referred to by investors in security markets. Information disclosed by this means is also thought to be able to significantly improve the efficiency of security markets. The research program adopts both qualitative (i.e., in-depth interview and observation) and quantitive research methods, employs the concept network approach in communication research to decompose CSR activities into Conformity and Differentiation dimensions, and demonstrates the differential influences of the two dimensions on distinct stages of security analysts’ decision making.

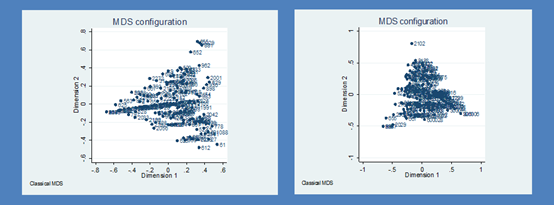

Figure 2. Illustration of the Conformity and Differentiation dimensions of CSR activities

The authors argued that security analysts’ evaluation of CSR activities is a “two-phase” process. In the first, “familiarity” phase, the goal is to determine whether a firm’s CSR activities meet the legal and institutional regulations. Firms engage in CSR following the guidelines issued by the government, thereby showing that their behavior complies with the regulations. Firms ranked higher on the Conformity dimension are thus more likely to be covered by security analysts. In the second, “reasoning” phase, analysts’ goal is to assess the strategic distinctiveness and hence the competitive advantage of a firm. Firms already meeting the regulative guidelines should then design and implement CSR practices that distinguish themselves from the competitors. In this sense, security analysts should be more likely to put forward higher recommendation for firms ranked higher on the Differentiation dimension. The paper empirically validates this hypothesis, demonstrating the goal-differing paths by which security analysts respond to CSR activities.

Figure 3. The two-phase model of security analysts’ evaluation of CSR activities

Adapted from TechBliss Solutions

This research finding has important implications for both CSR- related theories and management practice. First, drawing on a multi-dimensional perspective, the paper does in-depth analysis on Chinese firms’ CSR activities using the text analysis technique, revealing the diverse routes by which CSR activities reach their strategic value. Highlighting the match between CSR structure and security analysts’ decision making framework, this paper both extends the existing theories and offers firms potential strategies to design and implement CSR practices. Second, the paper shows systematically how distinct CSR dimensions could be related to security analyst’ goals at different stages, thereby providing security analysts with tools that can potentially be developed into a standard analysis template for evaluating CSR activities and ultimately helping improve information efficiency in security markets. Finally, this research offers implications as to how to refine the management of Chinese firms’ CSR practices, particularly, how to guide, with evidence-based policy, Chinese firms to effectively engage in CSR by integrating market value realisation and societal problem solving.

Link to the paper: https://doi.org/10.5465/amj.2017.0412