Date & Time:Dec. 10, 2019 10:00 - 11:30a.m.

Venue:SEM501 Meeting Room

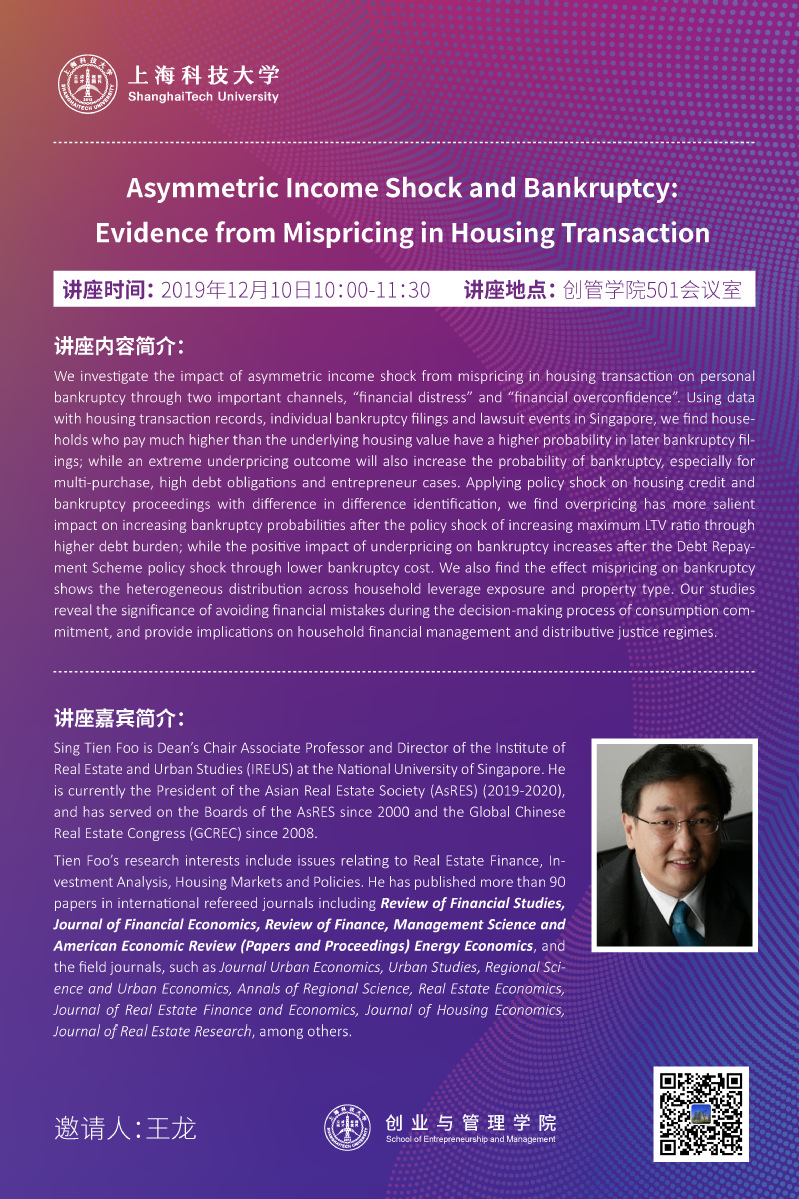

Speaker:SingTien Foo (National University of Singapore)

Abstract:

We investigate the impact of asymmetric income shock from mispricing in housing transaction on personal bankruptcy through two important channels, “financial distress” and “financial overconfidence”. Using data with housing transaction records, individual bankruptcy filings and lawsuit events in Singapore, we find households who pay much higher than the underlying housing value have a higher probability in later bankruptcy filings; while an extreme underpricing outcome will also increase the probability of bankruptcy, especially for multi-purchase, high debt obligations and entrepreneur cases. Applying policy shock on housing credit and bankruptcy proceedings with difference in difference identification, we find overpricing has more salient impact on increasing bankruptcy probabilities after the policy shock of increasing maximum LTV ratio through higher debt burden; while the positive impact of underpricing on bankruptcy increases after the Debt Repayment Scheme policy shock through lower bankruptcy cost. We also find the effect mispricing on bankruptcy shows the heterogeneous distribution across household leverage exposure and property type. Our studies reveal the significance of avoiding financial mistakes during the decision-making process of consumption commitment, and provide implications on household financial management and distributive justice regimes.

Speaker Biography:

Sing Tien Foo is Dean’s Chair Associate Professor and Director of the Institute of Real Estate and Urban Studies (IREUS) at the National University of Singapore. He is currently the President of the Asian Real Estate Society (AsRES) (2019-2020), and has served on the Boards of the AsRES since 2000 and the Global Chinese Real Estate Congress (GCREC) since 2008.

Tien Foo’s research interests include issues relating to Real Estate Finance, Investment Analysis, Housing Markets and Policies. He has published more than 90 papers in international refereed journals including Review of Financial Studies, Journal of Financial Economics, Review of Finance, Management Science and American Economic Review (Papers and Proceedings) Energy Economics, and the field journals, such as Journal Urban Economics, Urban Studies, Regional Science and Urban Economics, Annals of Regional Science, Real Estate Economics, Journal of Real Estate Finance and Economics, Journal of Housing Economics, Journal of Real Estate Research, among others.